Convert + verify bank statements

Mechanical verification you can stand behind.

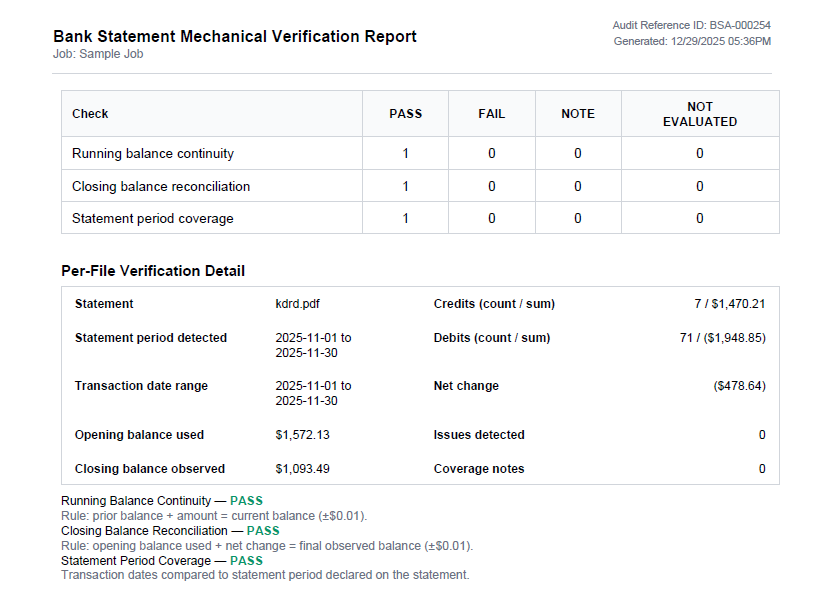

Upload statement PDFs and generate an evidence-ready verification report: balance reconciliation (opening + transactions = ending), reconciliation checks, continuity checks, and clean exports. Built for professionals who need defensible numbers — not opinions.

Built for professionals who need defensible numbers.

If your workflow depends on statement accuracy (and being able to show your math), BankStatementAudit helps you convert PDFs and document verification results consistently — without manual spreadsheets.

How it works

A simple, repeatable process designed for accuracy, speed, and defensibility.

Upload statement PDFs

Upload one or many bank statements (up to 20 per job). No bank logins, no credentials, and no data scraping.

Mechanical verification

Transactions are parsed and checked: balances, totals, continuity, and variance flags.

Export + report

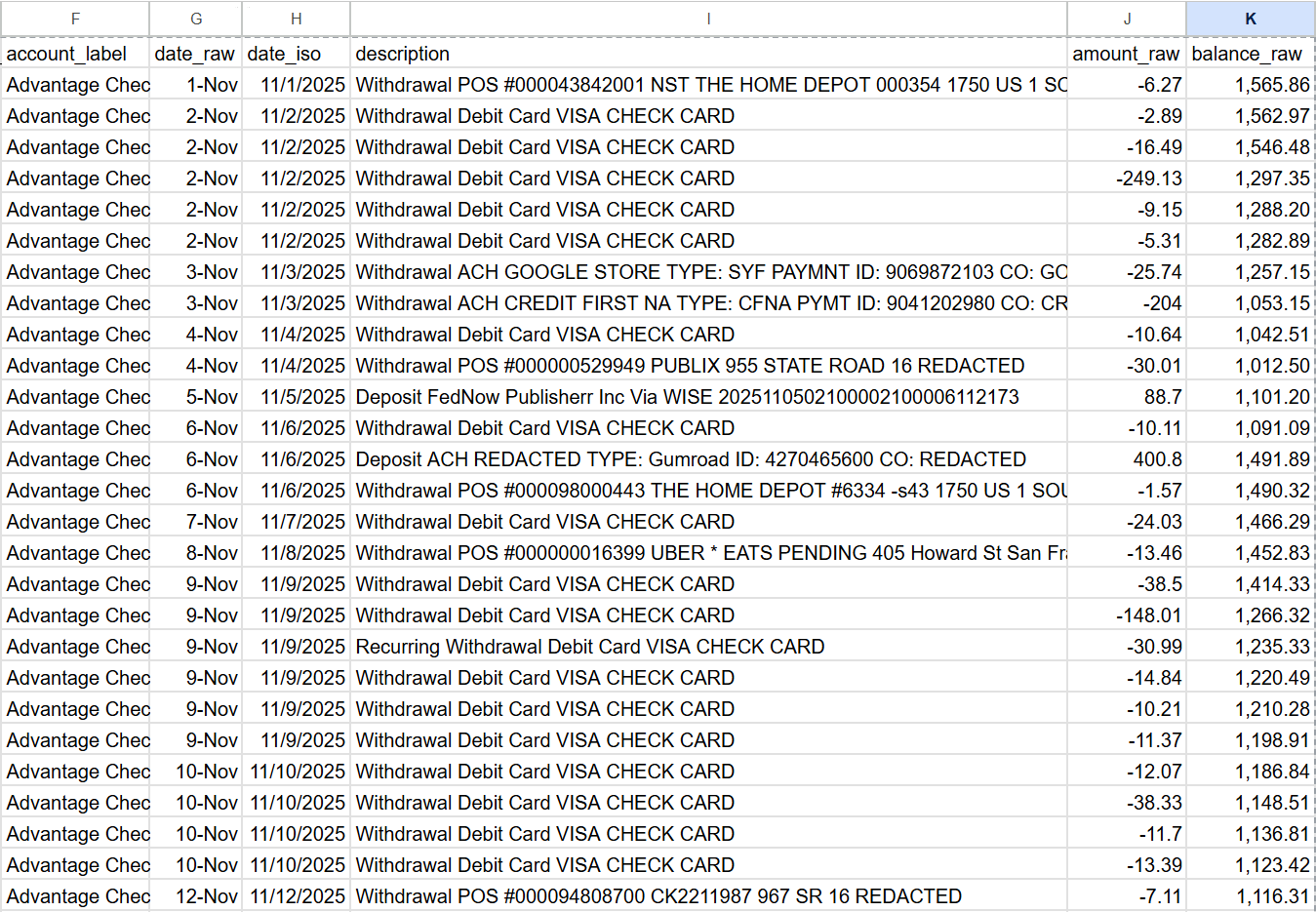

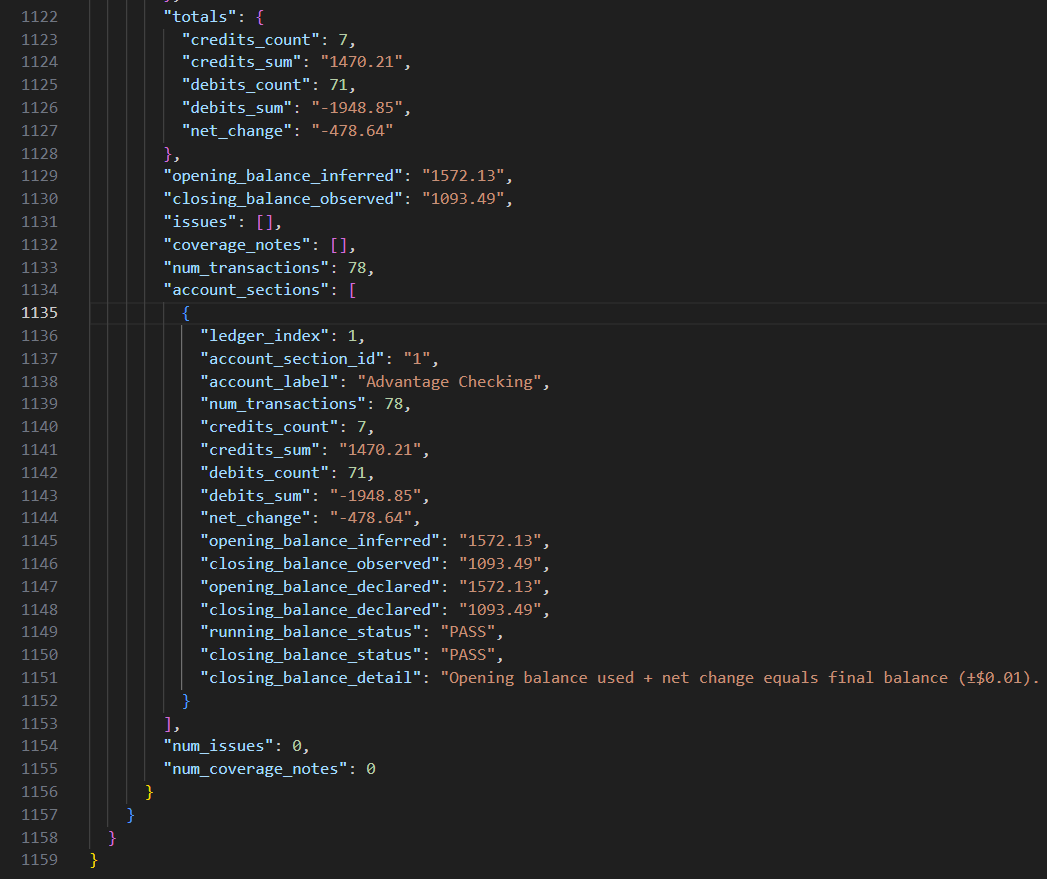

Download Audit PDF (free preview available; full values on paid plans) plus CSV and JSON for your records and downstream analysis.

What you receive

Every audit produces clear, professional artifacts designed for review, verification, and record-keeping — not black-box summaries.

Designed to surface inconsistencies that warrant review.

Mechanical verification checks can quickly reveal errors, omissions, or anomalies that are easy to miss during manual review — especially across multi-month or multi-account statement sets.

Balance inconsistencies

Flags cases where opening balance plus transactions does not equal the stated ending balance — even when the variance is small.

Missing or altered date ranges

Highlights gaps, overlaps, or unexpected discontinuities that may indicate missing pages, removed activity, or partial statements.

Statement period anomalies

Identifies mismatches between the stated statement period, transaction activity, and continuity across the document.

Incomplete or inconsistent documents

Surfaces conditions such as truncated statements or internal inconsistencies that may require follow-up.

Why professionals choose BankStatementAudit

Most tools extract data. We focus on verification, consistency, and evidence-ready outputs — without bloat.

Explainable results

Clear totals and checks you can re-verify. Built to support review and documentation.

Evidence-forward reporting

Audit-style PDF output with flags, totals, and an audit reference ID for your records.

Time savings without compromise

Reduce manual entry and cross-checking across statement sets while maintaining rigor.

Simple pricing

Same outputs on paid plans. Choose a monthly statement limit that matches your volume.

Simple pricing based on monthly statement limits.

All paid plans include the same deliverables (Audit PDF, CSV, JSON). Choose the limit that matches your monthly volume. Free includes a redacted Audit PDF preview.

- Audit PDF preview (values redacted)

- CSV export

- JSON export

- Verification checks + flags

- Standard processing

- Audit PDF (full values)

- CSV export

- JSON export

- Verification checks + flags

- Standard processing

- Audit PDF (full values)

- CSV export

- JSON export

- Verification checks + flags

- Priority processing

- Audit PDF (full values)

- CSV export

- JSON export

- Verification checks + flags

- Highest priority processing

Mechanical verification only — not a CPA audit. No financial advice.

Frequently asked questions

Clear answers for professionals who care about defensibility and process.